Welcome to CG Bonds Surety, your reliable ally in securing Retention Bonds. Our expertise lies in acquiring these bonds through a fusion of technical knowledge and experience. With a profound understanding of the complexities involved, CG Bonds ensures tailored solutions to meet the distinct needs of each client.

Retention Bonds

Welcome to CG Bonds Surety, your reliable ally in securing retention bonds. Our expertise lies in acquiring these bonds through a fusion of technical knowledge and experience. With a profound understanding of the complexities involved, CG Bonds ensures tailored solutions to meet the distinct needs of each client.

What Are Retention Bonds?

A Retention Bond may be requested by a beneficiary (housing associations/developer) to ensure the principles (contractors) work is completed to an agreeable standard. Half of the retention money is released upon completion and certification of the work and the other half is released at the end of the ‘Defects Liability Period’.

During this period, the principle is liable to remedy any faults in their work, and at the end of this period (which usually lasts between 6-24 months), the other half of the retention money can then be returned to the principle.

Without a Retention Bond, the principle is required to use their cash as the ‘retention money’. This ties cash flow up for a long time and will negatively affect the liquidity of the principle.

Why Would Someone Need A Retention Bond?

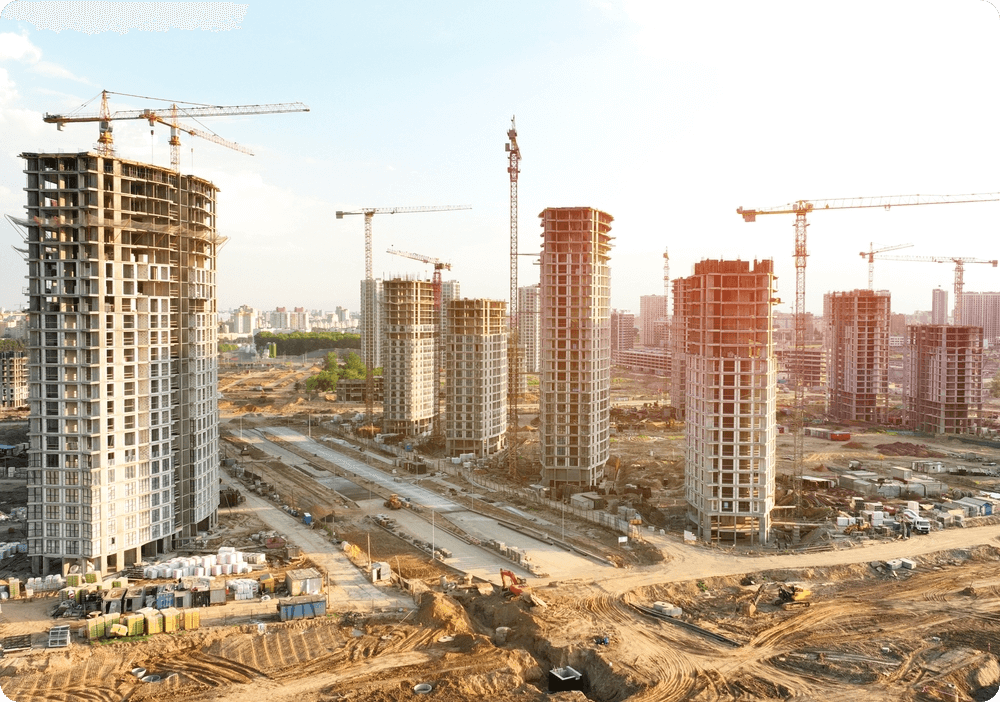

A Retention Bond is essential in construction contracts to secure payment for subcontractors and ensure the completion of projects. It addresses the common practice of withholding a percentage of the contract value until project completion, providing financial assurance to subcontractors.

Additionally, project owners use Retention Bonds to safeguard against financial loss due to incomplete or defective work, promoting timely and quality project delivery. The bond enhances a contractor’s credibility in the bidding process, demonstrating commitment and financial responsibility. In summary, a Retention Bond is a crucial tool for fostering trust, mitigating risks, and fulfilling contractual obligations in the construction industry.

Why Would Someone Need A Retention Bond?

A retention bond is essential in construction contracts to secure payment for subcontractors and ensure the completion of projects. It addresses the common practice of withholding a percentage of the contract value until project completion, providing financial assurance to subcontractors.

Additionally, project owners use retention bonds to safeguard against financial loss due to incomplete or defective work, promoting timely and quality project delivery. The bond enhances a contractor’s credibility in the bidding process, demonstrating commitment and financial responsibility. In summary, a Retention Bond is a crucial tool for fostering trust, mitigating risks, and fulfilling contractual obligations in the construction industry.

How Does A Retention Bond Work?

The cost of a Retention Bond depends on factors such as the bond amount, contractor’s financial stability, project risk, bond duration, and the policies of the surety company. Contractors with lower risk and solid financials may qualify for more favourable rates.

To obtain accurate cost estimates, contractors should engage directly with surety companies, providing comprehensive information during the application process. In summary, understanding these factors is essential to determine competitive and accurate costs for Retention Bonds in construction projects.

How To Secure A Retention Bond

To obtain a Retention Bond from CG Bonds Surety, our dedicated client account mangement team is here to support you every step of the way. To kick start the application process, we will ask for the essential information outlined here:

![]() Completed and Signed Application Form

Completed and Signed Application Form

![]() Most Recent Audited Financial Accounts

Most Recent Audited Financial Accounts

![]() Copy of Bond Wording (if available)

Copy of Bond Wording (if available)

How CG Bonds Surety Can Help You With Retention Bonds

CG Bonds Surety is your reliable partner for securing Retention Bonds, providing dedicated assistance and expertise throughout the process. With a client-centric approach, our team offers tailored solutions, leveraging unrivalled technical knowledge in the construction industry.

Backed by an exclusive underwriting panel and a 100% track record, CG Bonds Surety ensures competitive terms and client satisfaction. Choosing CG Bonds Surety guarantees not only financial expertise but also peace of mind, with a commitment to excellence evident in our industry standing.