CG Bonds not only offers expertise in Restoration Bonds but also guarantees the most competitive terms in the market. With us, you gain not only the assurance of bond proficiency but also the peace of mind that your distinct requirements are in capable hands.

What Are Restoration/Environmental Agency Bonds?

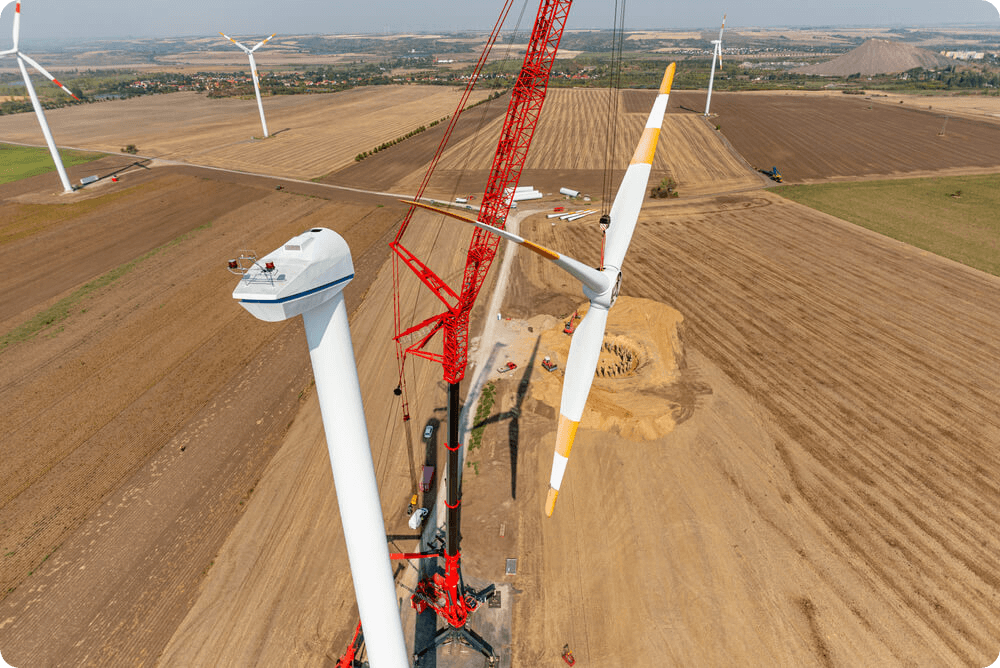

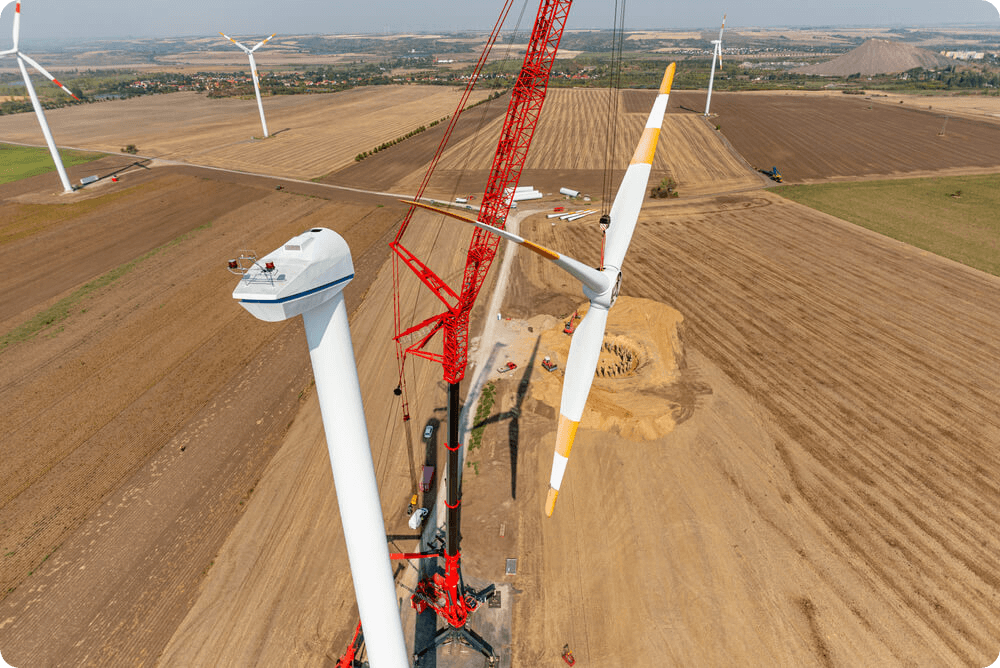

A Restoration/Re-Instatement or Environmental Agency Bond is a guarantee to a Local Authority or the Environment Agency (beneficiary) which ensures the Developers/Renewable Energy Contractors (principle) restores the land, upon completion, to an agreeable standard – as detailed in the wording.

This bond ensures the removal of hazardous materials, foundations, underground electrical wires, and access roads, etc. It also ensures the vegetation is restored to its original state.

These bonds ensure sufficient protection of our environment and are common amongst a range of different UK industries such as landfill, recycling, quarry, chemical, oil, land management and many more.

Why Would Someone Need A Restoration/Environmental Agency Bond?

A Restoration/Re-Instatement/Environmental Agency Bond is a crucial financial tool mandated by environmental regulations and legal requirements. Individuals and businesses often need these bonds to demonstrate compliance with established standards and ensure responsible environmental practices. The bond serves as a commitment to mitigating potential environmental harm, providing financial assurance for activities that may have adverse effects on ecosystems.

Whether required by government agencies for project approval, industry-specific regulations, or as a means to enhance public trust, these bonds play a pivotal role. In the event of environmental damage, the bond guarantees the availability of funds for timely restoration efforts, fostering long-term environmental protection. Ultimately, Restoration/Re-Instatement/Environmental Agency Bonds serve as a proactive and responsible approach to managing environmental risks and ensuring the sustainable operation of businesses and projects.

Why Would Someone Need A Restoration/Environmental Agency Bond?

A Restoration/Re-Instatement/Environmental Agency Bond is a crucial financial tool mandated by environmental regulations and legal requirements. Individuals and businesses often need these bonds to demonstrate compliance with established standards and ensure responsible environmental practices. The bond serves as a commitment to mitigating potential environmental harm, providing financial assurance for activities that may have adverse effects on ecosystems.

Whether required by government agencies for project approval, industry-specific regulations, or as a means to enhance public trust, these bonds play a pivotal role. In the event of environmental damage, the bond guarantees the availability of funds for timely restoration efforts, fostering long-term environmental protection. Ultimately, Restoration/Re-Instatement/Environmental Agency Bonds serve as a proactive and responsible approach to managing environmental risks and ensuring the sustainable operation of businesses and projects.

How Does A Restoration/Environmental Agency Bond Work?

A Restoration/Re-Instatement/Environmental Agency Bond operates as a crucial financial safeguard, requiring individuals or businesses engaged in environmentally impactful activities to secure a bond as a condition of regulatory compliance. Obtained through a surety company, the bond serves as a binding agreement, ensuring that the bonded entity adheres to environmental regulations and commits to restoring or reinstating any damage caused. This financial instrument acts as a guarantee that funds will be available for environmental remediation if the bonded party fails to fulfil its obligations.

How To Secure A Restoration/Environmental Agency Bond

To acquire a warranty bond from CG Bonds Surety, our client account manager is committed to assisting you throughout the process. To initiate the application, we’ll request the following key information:

![]() Completed & Signed Application Form

Completed & Signed Application Form

![]() Most Recent Audited Financial Accounts

Most Recent Audited Financial Accounts

![]() Copy of Bond Wording (if available)

Copy of Bond Wording (if available)

When Does A Restoration/Environmental Agency Bond Expire?

The expiration of a Restoration/Re-Instatement/Environmental Agency Bond is contingent upon various factors outlined in the bond agreement. Typically, the bond’s duration is influenced by regulatory requirements, project timelines, and ongoing operational considerations. Regulatory standards may mandate specific renewal periods, aligning with compliance periods or reporting requirements. In projects with defined timelines, the bond may expire upon successful completion of restoration or re-instatement activities.

For businesses engaged in continuous operations with environmental implications, the bond’s expiration may necessitate renewal at regular intervals. The terms and conditions of the bond agreement, including the specified expiration date, dictate the renewal process. Principals should proactively manage the renewal, initiating the process ahead of the expiration date and providing any required updates or information to the surety company for reassessment. Understanding these factors ensures compliance, prevents lapses in coverage, and maintains the financial assurance necessary for potential environmental remediation efforts.

Restoration/Environmental Agency Bond Costs

The cost associated with a Restoration/Re-Instatement/Environmental Agency Bond is a dynamic calculation influenced by factors like principle’s financial stability, nature of the bond wording, and availability of additional security. Engaging with a reputable surety company and providing thorough information during the application process are essential steps in obtaining accurate and competitive bond costs.

Benefits Of Getting Restoration/Environmental Agency Bonds From CG Bonds Surety

CG Bonds Surety stands as a reliable partner in helping individuals and businesses secure Restoration/Re-Instatement/Environmental Agency Bonds. With specialised knowledge and expertise, the dedicated client account management team guides clients through an efficient application process, offering personalised assistance. Leveraging an exclusive underwriting panel, CG Bonds Surety ensures competitive terms and boasts a 100% track record in fulfilling bond requirements. The company’s renowned reputation reflects its commitment to client satisfaction and environmental responsibility, making it a trusted choice for tailored bond solutions.

- Fast Quote Turnaround – At CG Bonds, we adhere to strict Service Level Agreements, endeavouring to deliver quotes as efficiently as possible as we recognise the importance of quick quote turnaround undertaking multiple bond executions through CG Bonds.

- 100% Track Record in Fulfilling Bond Requirements – We take immense pride in our impeccable track record of ensuring compliance with the terms of all bond applications.

- Exclusive Underwriting Partnerships – CG Bonds has brought together an unmatched and exclusive underwriting panel, establishing a standard that surpasses others in the industry.

- Bond Finance Options – CG Bonds offers deferred payment options for every bond application, presenting a valuable solution to ease the initial capital strain on your projects.

- Best Price Guarantee – CG Bonds operate a Best Price Guarantee Policy, helping our clients achieve the best possible terms.